19+ paycheck calculator kentucky

How much you pay in federal income taxes depends on the information you filled out on your Form W-4. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223.

Raceland Meadows Apartments 534 Raceland Meadow Dr Raceland Ky Rentcafe

This income tax calculator can help estimate your average income.

. This is the form that tells your employer how. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. This free easy to use payroll calculator will calculate your take home pay.

Minnesota paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. Our calculator has recently been updated to include both the latest Federal Tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky. Kentucky Salary Paycheck Calculator. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Free Kentucky Payroll Tax Calculator and KY Tax Rates. The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income. Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky. Tylenol dosage by weight calculator. How Your Kentucky Paycheck Works.

Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Use our easy payroll tax calculator to quickly run payroll in Kentucky or look up 2022 state tax rates.

Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State. Employers can enter an.

On the other hand if you make more than 200000 annually you will pay. Simply enter their federal and state W-4 information as. Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

Calculating paychecks and need some help. Supports hourly salary income and multiple pay frequencies. COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit.

Kentucky Hourly Paycheck Calculator Gusto

Mallard Crossing At St Matthews Apartments 400 Mallard Creek Rd Louisville Ky Rentcafe

How To Use C To Calculate Things Like Math Sqrt 2 Math To An Arbitrary Number Of Decimal Places Quora

Hi Fishes An Offer Letter From Impetus What W Fishbowl

Us Vs Uk Doctors Salary Detailed Comparison Revising Rubies

G608296 Jpg

Plenarvortrage Dpg Tagungen

Hi Fishes An Offer Letter From Impetus What W Fishbowl

Kentucky Hourly Paycheck Calculator Paycheckcity

Kentucky Derby 2022 Long Shots Expert Analysis On Kentucky Derby Underdogs

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Us Vs Uk Doctors Salary Detailed Comparison Revising Rubies

Kentucky Paycheck Calculator Smartasset

Pdf Consumption Of Non Nutritive Sweeteners By Pre Schoolers Of The Food And Environment Chilean Cohort Fechic Before The Implementation Of The Chilean Food Labelling And Advertising Law

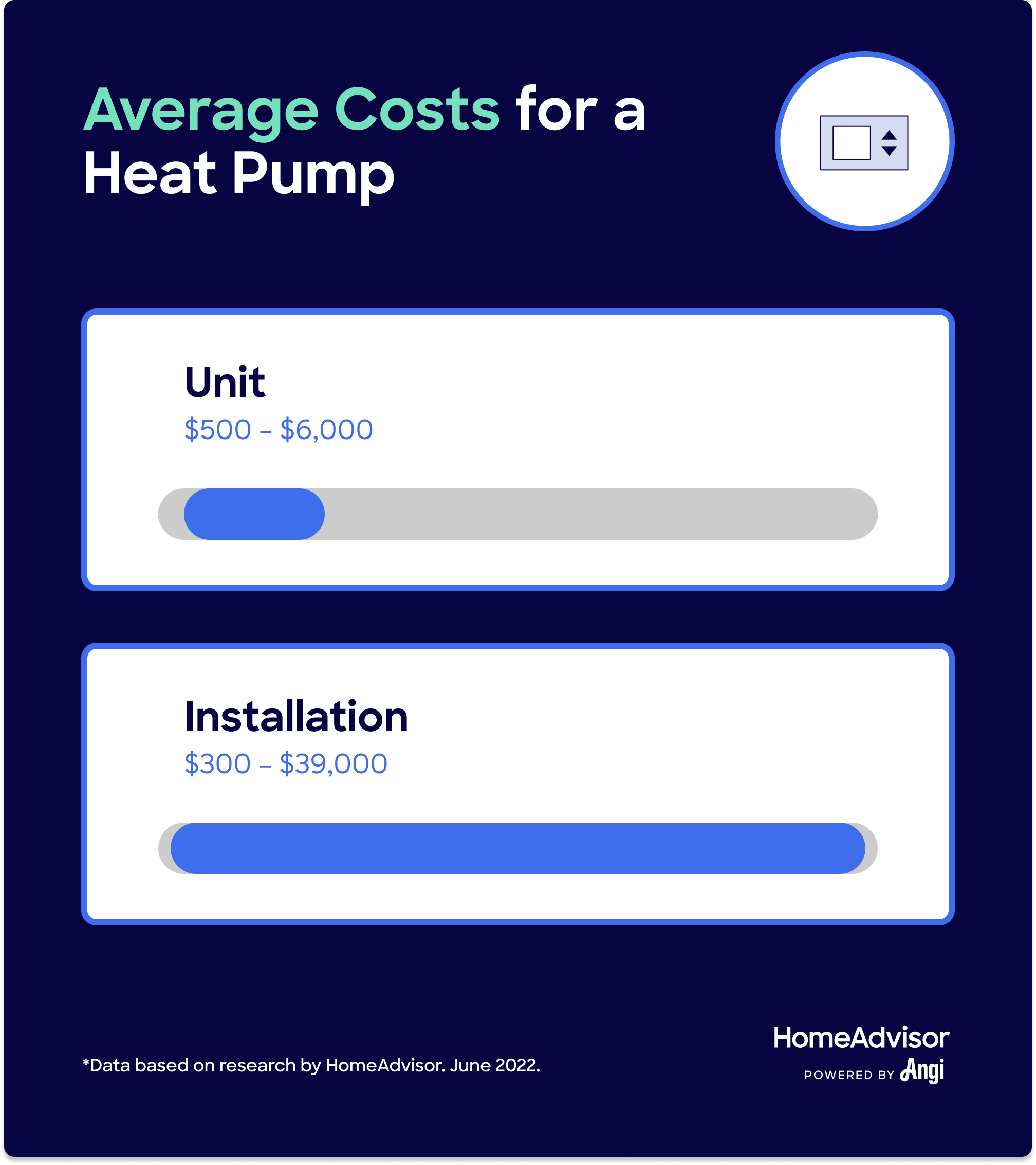

How Much Does A Heat Pump Cost To Install

Kentucky Paycheck Calculator 2022 2023

Liberty Manor Apartments 240 Butcher Street Liberty Ky Rentcafe